Just over a decade ago, the European online gambling and betting market was a utopia for online casinos, sportsbooks and affiliates alike. Regulations were few, taxes didn’t exist and the whole deal was still rather new for everyone involved.

Things started to change as the opportunity drew in more and more competitors on every landscape. Everyone wanted a chunk of the cake. Regulations started to kick in as well in many countries, which further shrunk the income of operators due to taxation, fees or rules. The Swedish market, regulating in January 1, 2019 is a good example, with rules on welcome bonuses and promotions, the player value became much smaller.

Both operators and affiliates have started looking outwards, seeking new opportunities in other markets. Over the last 2 or 3 years the buzz has been mainly around two words: USA (reversing PASPA and regulating sports betting on several states starting late 2018) and BRIC – Brazil (which moves towards sports betting regulation), Russia (Where sports betting is legal), India and China, with their massive population and growing economies. But are these necessarily the correct markets to enter? We would actually like to challenge that. The world is full of opportunities that for many different reasons are being overlooked. Blue oceans still exist, and we are here to offer several aspects to look at, before making the choice everybody else does when thinking of “new markets”.

Internet growth, booming economies, new regulations, growing populations – all of these are factors to look at when choosing a new market. Here are some examples:

Southeast Asia

Some facts:

- There are 360 million internet users in the area, 90% through mobile phones

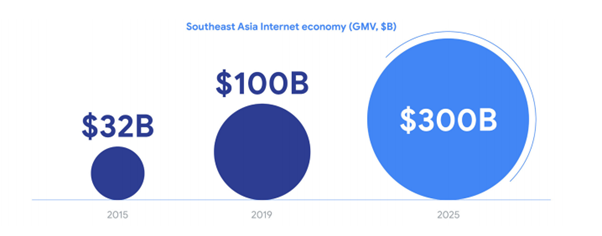

- SEA’s internet economy hits $100 billion, projected to hit $300 billion by 2025

- Internet economies grow by 20-40% annually (depends on the country)

While China is always an interesting market, gambling in all its forms is legal only by state-operated companies. Moreover, the Chinese government goes above and beyond when trying to stop illegal online gambling. And since Western sites like Google and Facebook are blocked in China, and the local equivalents such as Baidu are abiding the government, it’s a very tough market to enter. But to the South of China there’s a whole world of online betting. Philippine-licensed operators target Southeast Asian countries, markets of football enthusiasts (mostly English Premier League), with growing economics and quite a few people…

Sub-Saharan Africa

Some facts:

- Africa is the second populated continent in the world, and its population is expected to double by 2050

- While Africa is still behind the rest of the world in terms of Internet penetration, investments over the last few years have helped to improve the situation. For example, Kenya jumped from 14% internet penetration in 2010 to 87% in 2020. Nigeria’s internet penetration is only 61% – which is still translated to more than 120 million people

- By 2025, Sub-Saharan Africa is expected to have 600 million smartphone users, which will help driving forward the internet penetration

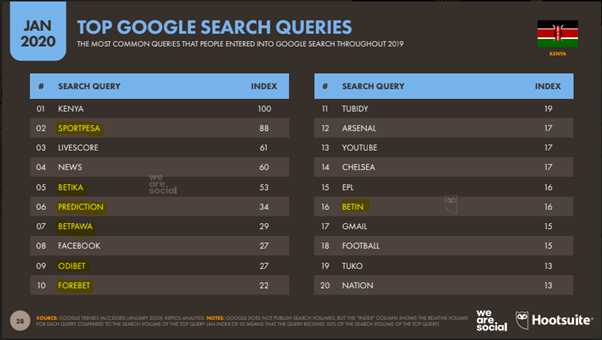

- In Kenya, 6 out of the most 10 searched keywords are betting related

Sports Betting is quite major in Sub-Saharan Africa. It might be surprising to know that it is legal and regulated across many countries, including South Africa, Kenya, Nigeria, Tanzania, Uganda, Ghana and many more. Local brands who also own brick-and-mortar shops are widely known and widely searched.

Lately we learn even that the Kenyan Government is eliminating a controversial 20% tax on sports betting, which opens the door to the return of some big brands which stopped working in the country, like Sportpesa and Betin.

Arabic Countries

Two things are a common knowledge in the iGaming industry:

- It is prohibited to gamble in most Muslim countries; and yet

- GCC Player value is over the roof

But there are other, little-known facts, worth mentioning.

Unlike many Muslim countries, in Morocco, Egypt and Lebanon there are no laws prohibiting online gambling, which created a flourishing ground for online players.

A report from 2017 showed Moroccans spent approximately US$1billion on gambling in 2016.

In Lebanon, the only legal land-based casino has been seeking the opportunity to go online, and launched a tender for an online gambling technology partner.

And while many operators accept Arabic-speaking customers, it is very much a “by-the-way” approach and doesn’t seem like a focused strategy. There are little to none Arabic-first operators out there, localizing and catering to the Arab user as they do for other countries, regulated or none regulated. And with that in mind, the opportunity to do so should definitely cross one’s mind when seeking out a winning edge over the competition.

Conclusion

iGaming competition in Europe, North America, Latin America and several Asian countries like Japan and India is getting harder and harder. When searching for growth opportunities, it is easy to follow the trends, but it is not always necessarily the right thing to do. When opportunities sometimes just wait to be taken, it is thorough market research and understanding that can sometimes be a winning factor.

At times, it would be a new market not many others are looking at. Or it could be one that is being wrongly evaluated or mistreated. Low hanging fruits are out there. Now it’s just a question of who can pluck them out.

Luckily, Leverage is here to do the homework for you. Contact us, and let’s talk about your growth opportunities into new markets.